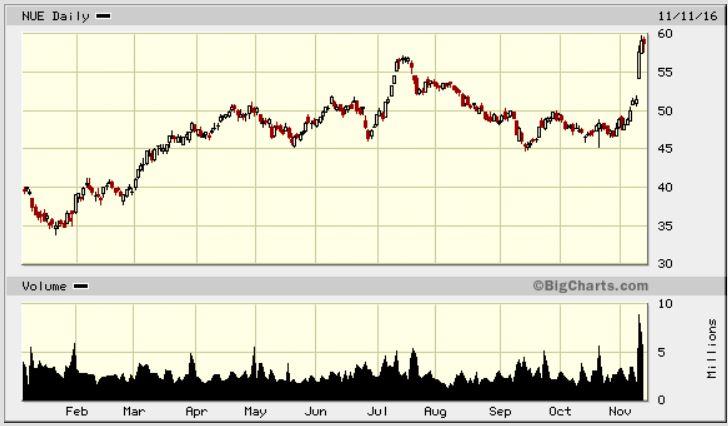

The interface might draw off some stock market newbies, but on the whole the site does what it is meant to do: inform people on how their stocks are doing. The site serves a key informative function for anyone who is looking to make the most out of their stock markets investments. “BigCharts is the world’s most comprehensive and easy-to-use investment research Web site, providing access to professional-level research tools such as interactive charts, quotes, industry analysis and intraday stock screeners, as well as market news and commentary.” Why It Might Be A Killer It allows you to incorporate both the historical data found on the Historical Quotes with the up-to-date information found on the IndexWatch, and have an increased understanding of how any company is going to stand in relation to your investments in the near future. On the other hand, the Interactive Chart is a more extensive version of the IndexWatch. There, you will be able to choose the company you want to know more about and see how its stocks have been performing ever since it started being a publicly traded company. Free, award-winning financial charts, trading tools, analysis resources, market scans and educational offerings to help you make smarter investing decisions. The Historical Quotes are a great resource for anyone who wants to inquire about the past history of any company. This is unarguably the site’s most valuable tool, and (not coincidentally) it is the first thing that you see when you visit it.Īnd then, there’s two other great tools that you can also use at no cost: the Historical Quotes, and the Interactive Chart. This allows you to see how any major player in the stock market is evolving over time. The key feature of the site has to be the IndexWatch feature. This service can be accessed at, and the site has already got everything any stock holder will need to keep up with his stock options.

In a nutshell, Big Charts makes it painless to stay on top of all your stocks, even when you have little time to do so. Chief Executive Chip Bergh noted “continued softness in the wholesale channel, primarily in the U.S.Presented by, Big Charts is a service that no person who is into the Stock Market could turn a cold shoulder to.

Big charts market watch free#

Analysts polled by FactSet expected adjusted earnings per share of 27 cents on $1.54 billion in sales. At Yahoo Finance, you get free stock quotes, up-to-date news, portfolio management resources, international market data, social interaction and mortgage. Adjusted for impairments, goodwill and other items, Levi Strauss earned 28 cents a share. Revenue slipped to $1.51 billion from $1.52 billion in the same quarter a year earlier. The company reported third-quarter net income of $9.6 million, or 2 cents a share, compared with $172.9 million, or 43 cents a share, in the same quarter last year. Salesforce ‘very thirsty’ to be AI CRM leader, Benioff says following strong outlook, improved margins. Salesforce’s margin story impresses, but bulls say that’s not the only thing working MarketWatch. They also said they expected sales to be flat to up 1%, compared with expectations given in July for gains of 1.5% to 2.5%. Due to popular demand, we have added Palladium to the list of Analytical Charts that Metals Analyst Jim Wyckoff features. These stocks the ‘beating heart’ of the economy are in trouble, says strategist MarketWatch. Executives said they expected full-year adjusted per-share profit to be “on the low end” of a prior forecast of between $1.10 and $1.20 a share. The companys website offers access to professional-level research tools such as interactive charts.

retailers take a more conservative approach to restocking their shelves with new clothing. LEVI fell after hours Thursday after the jeans maker tempered its full-year outlook, as U.S. Levi’s stock falls on cautious outlook, amid ‘continued softness’ in U.S.

0 kommentar(er)

0 kommentar(er)